Morningstar: thanks to a spectacular market rebound and a return to favor of funds that started in April, assets in long-term funds hit an all-time high in 2020.

While net flows were a far cry from the record-breaking year of 2017 when long-term funds were flooded with EUR 754 billion, net sales of EUR 256 billion in fourth-quarter 2020 set a historical record. (In a mirror image, the outflows seen in the first quarter were also record-breaking.)Global large-cap blend equity funds saw the highest inflows on a Morningstar Category level in December, raking in more than EUR 12.5 billion for the month. For the full year, global equity growth and technology equity funds were the most-loved categories.

It was another annus horribilis for alternative multistrategy funds, which suffered heavy outflows over the course of the last year.BlackRock topped the list of active managers in December, and also bagged the crown for the full year thanks to flows towards its technology and healthcare equity fund categories. Invesco, Franklin Templeton, and M&G suffered double-digit billion EUR outflows in 2020.

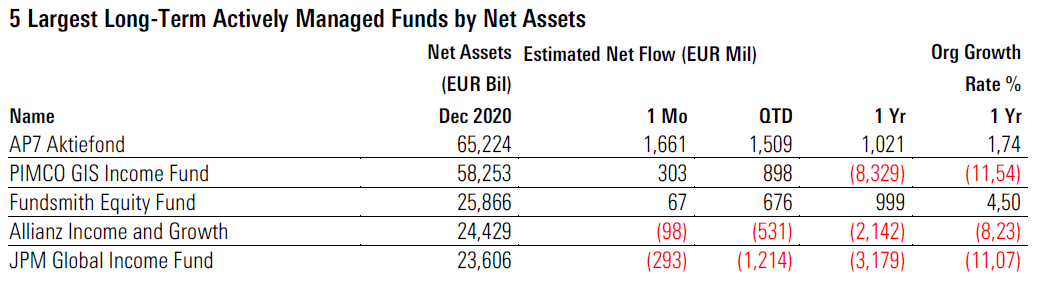

On the passive side, iShares largely outpaced its competitors, while State Street and Pictet suffered the heaviest redemptions in 2020.Thanks to the equity rally in the fourth quarter and strong December inflows, the Swedish pension fund AP7 Aktiefond regained the title of Europe’s largest long-term fund at the expense of Pimco GIS Income Fund.

2020: Eye-Watering Fourth-Quarter Inflows Bring a Remarkable Year to a Close It was clear well before the books were closed on the last days of December that 2020 would be a positive year for Europe’s fund industry and investors alike. It remained unclear just how good the year could get. Morningstar’s European Asset Flow data now reveal that 2020 was a spectacular year–even after fund promoters had been overwhelmed by the first quarter’s gargantuan market crash and huge redemptions. Thanks to an amazing market rebound and a return to favor of funds that started in April, assets in long-term funds hit an all-time high in 2020. With net inflows of EUR 426 billion and marketappreciation effects of EUR 85 billion, net assets in long-term funds stood at EUR 10.36 trillion. When including money market funds, Europe-domiciled fund assets amounted to EUR 11.84 trillion, also a record amount. While net flows were a far cry from record-breaking 2017, when long-term funds were flooded with EUR 754 billion, net sales of EUR 256 billion in fourth-quarter 2020 set a historical record. (Morningstar started collecting European flows on an industry level in 2007.)

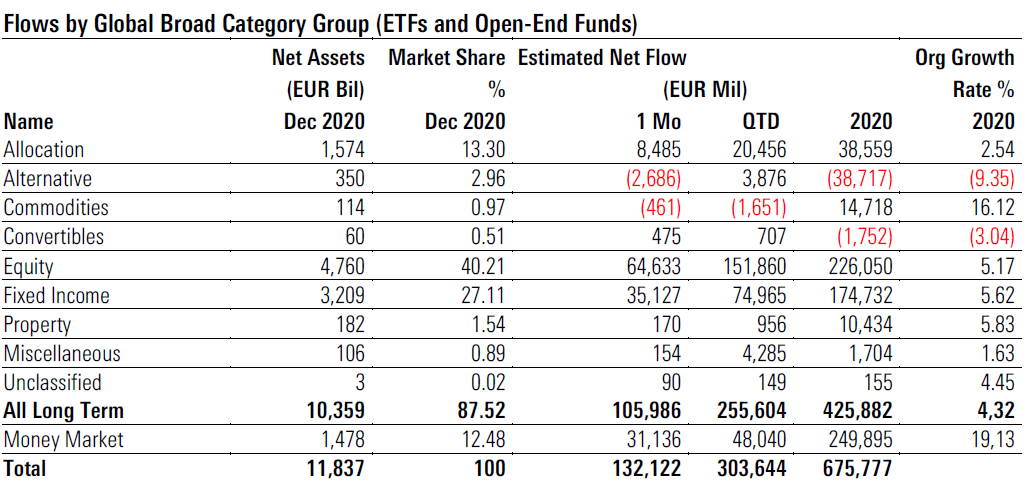

However, in a mirror image, the first quarter of last year also set a negative record: Outflows were the highest in any three-month period, thus even outpacing the redemptions that exited long-term funds during the financial crisis. As equity markets continued to storm ahead in the fourth quarter, ever more investors joined the party, sending EUR 152 billion of the last year’s tally of EUR 226 billion to equity funds. This made 2020 the strongest year on record for equity funds. Bond funds took in net inflows of EUR 175 billion, a far cry of record-breaking inflows of EUR 342 billion seen in 2019, but it is noteworthy to remember that bond funds had suffered eye-watering outflows of EUR 80 billion in the first quarter, which by far outpaced the redemptions of EUR 39 billion that hit equity funds in the first quarter. Inflows to allocation funds also recovered as the year progressed, but total inflows of EUR 38.5 billion made 2020 the second-worst year since 2013 for mixed assets’ funds.

Commodity funds thrived and took in a record-shattering EUR 14.7 billion, which came on the back of a rush for gold exchange-traded products, which are perceived as safe-haven assets by many investors in times of crisis. For alternative funds, 2020 was another annus horribilis. These hedge-fund-mimicking vehicles hemorrhaged EUR 39 billion, down the third year in a row as many investors seem to have given up hope on the performance qualities of absolute return funds. Money market funds saw inflows of EUR 250 billion, the highest level of inflows on record. EUR money market funds witnessed the highest inflows of all money market categories. The bulk of the inflows targeted these short-term vehicles not in the first but in the second quarter. EUR money market funds enjoyed hefty inflows.

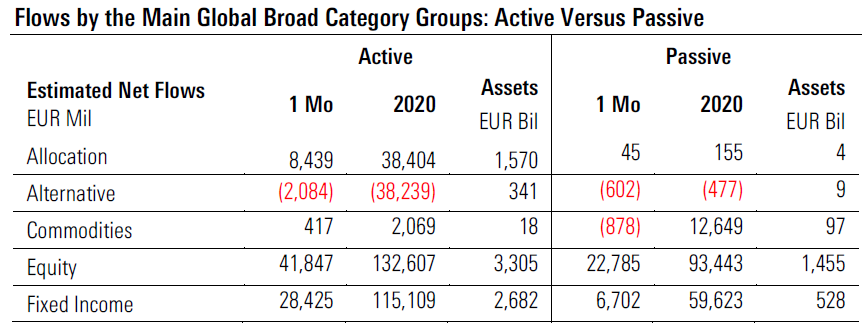

Active Versus Passive Long-term open-end index funds and exchange-traded funds posted net inflows of EUR 165 billion in 2020 versus the EUR 510 billion that targeted actively managed funds (The table below only includes data for the main broad category groups.). When adjusted for size, flows to passive funds outpaced actively managed funds. Thanks to the organic growth rate of 8.7% in the trailing 12-month period versus a 5.5% growth rate for actively managed funds, the market share of index funds rose from 17.09% at year-end 2019 to 17.75% of the assets of long-term funds in Europe as per December 2020.

Actively managed funds benefited from strong demand seen in the fourth quarter of last year, with December being an exceptionally strong month. Of the total inflows of EUR 510 billion sent to actively managed long-term funds in 2020 (the below table shows only the main broad category groups), EUR 239 billion were pulled in during the last three months of the past year. This trend was especially strong in the equity fund sphere as EUR 97 billion of the total year’s inflows of EUR 133 billion were invested in the fourth quarter (another record broken in the final three months of 2020!). This trend was not nearly as strong for actively managed allocation and bond fonds. Within the universe of long-term index funds, EUR 65 billion of total long-term funds’ inflows of EUR 165 billion were invested in the fourth quarter.

For the whole year, long-term ETFs grabbed EUR 96 billion, while open-end index funds took in EUR 72.5 billion. This arguably illustrates that transborderdistributed ETFs are outpacing the locally focused open-end index funds. As of year-end 2020, EUR 1,022 billion was invested in ETFs (48%) versus the EUR 1,092 billion that sat in open-end index funds (52.0%).

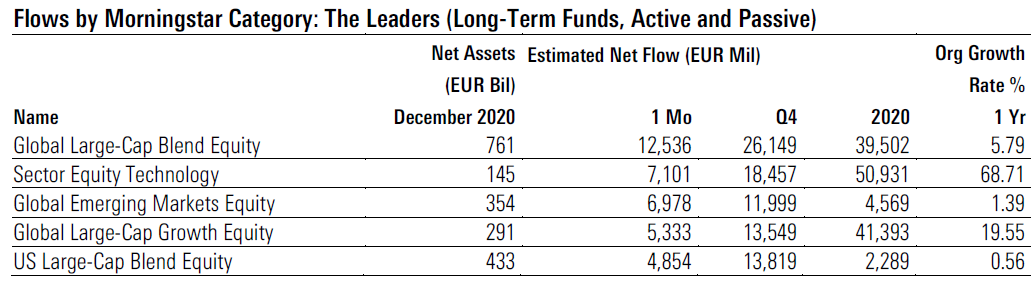

Fund Categories: The Leaders A look at the top-selling Morningstar Categories reveals strong demand for global large-cap blend equity funds, which were showered with EUR 12.5 billion of inflows in December, their highest monthly result since Morningstar started collecting data on fund flows in 2007. Both actively managed and index funds shared the spoils, with EUR 7 billion and EUR 5.5 billion taken in, respectively. With EUR 7.1 billion of net inflows, sector equity technology funds were the second-most sought-after products last month. Thanks to its superior performance, this category was the most loved by investors in 2020, with EUR 51 billion of net new money. ©2021 Morningstar, Inc. All rights reserved. Global large-cap growth equity funds attracted EUR 5.3 billion last month, the highest inflows since July 2019.

Morgan Stanley’s Global Opportunity Fund was the top seller within the category in December (EUR 576 million) and in the whole 2020 (EUR 4.3 billion). One of the overriding themes in 2020 was the popularity of the growth style as well as sustainable investing (which are covered in a separate, forthcoming commentary). No surprise then that global large-cap growth equity funds earned the second place in terms of 2020 flows, gathering last year EUR 41.4 billion, and global large-cap blend equity funds, which have relative growth biases, earned third place among Morningstar Categories. Global emerging markets equity also enjoyed a record-breaking level of inflows in December 2020. Amundi MSCI Emerging Markets UCITS ETF was the top seller in the category, with EUR 723 million of new subscriptions. Flows were evenly split between active and passive products.

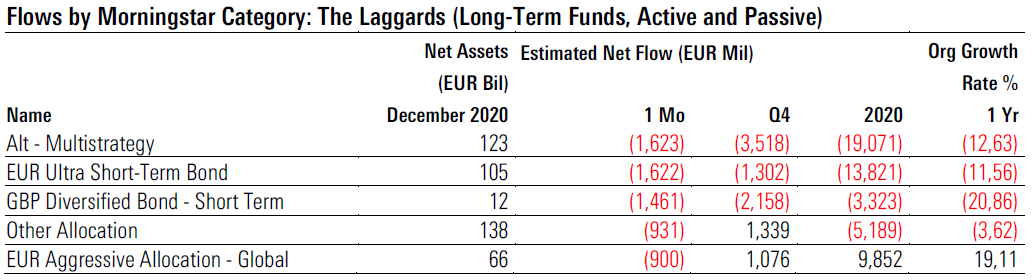

Fund Categories: The Laggards Investors continued to shy away from alternative funds, particularly from multistrategy products, which shed EUR 1.6 billion in December, thus marking their 30th consecutive month of outflows. The year 2020 played out as another annus horribilis for these funds, which invest in multiple alternative strategies, with EUR 19 billion walking out the door. This category has seen its assets under management collapse to EUR 123 billion from EUR 189 billion over the past three years, owing to the combination of outflows and negative performance.

The outflows from EUR ultra-short-term bond and GBP short-term diversified bond funds bore witness to the fact that investors were in a risk-on mode for the better part of the year. Among the trends that played out over the full year (and that are not shown in the table, which is sorted by December outflows), US large-cap value equity funds suffered significant outflows (EUR 10 billion of net redemptions) but made a comeback of sorts in the fourth quarter, netting inflows of close to EUR 850 million. Robeco suffered the most on a branding-name level, as investors pulled out close to EUR 2 billion from its US large-value funds.

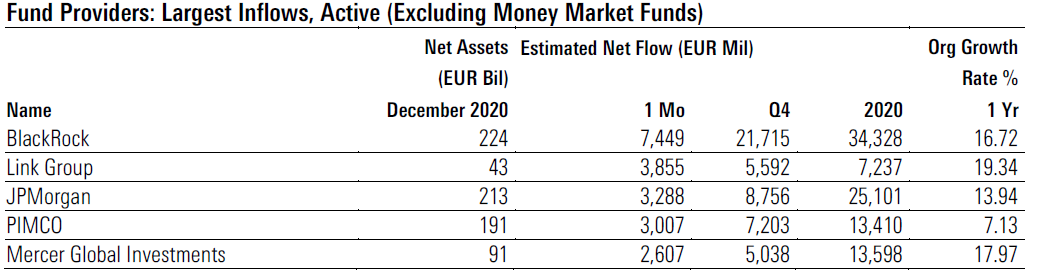

Fund Providers: The Leaders While BlackRock is by now associated foremost with its index funds brand, iShares, the actively managed funds of the behemoth US fund provider topped the ranking of active managers in December thanks to hefty inflows sent to its equity and bond funds. In last year’s total, BlackRock actively bagged an astounding EUR 34 billion, followed by the asset management arm of JPMorgan, which drew in EUR 25 billion. A closer look reveals that JP Morgan’s strength rested on multiple fixed-income and equity categories such as USD flexible-bond funds, USD high-yield bond funds, China A-shares, and global emerging-markets equity funds. Pictet benefited from the huge demand for sector ecology and sector alternative energy funds in 2020.

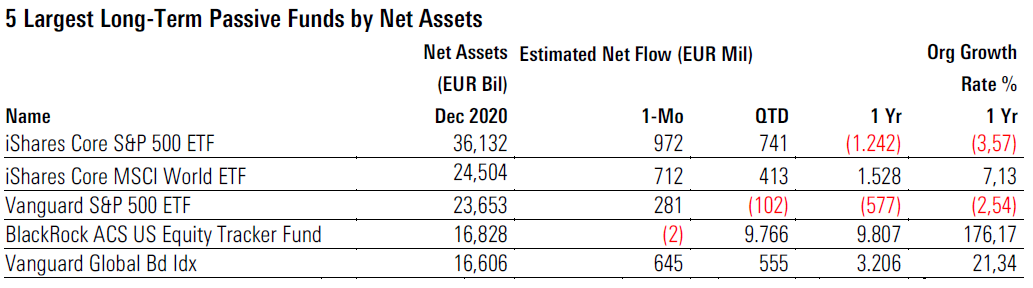

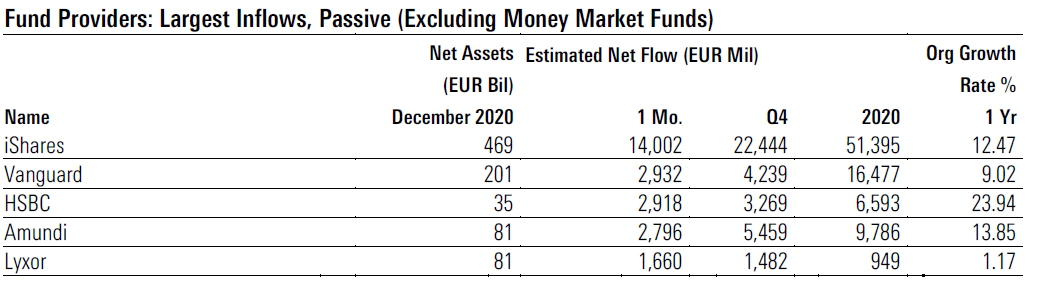

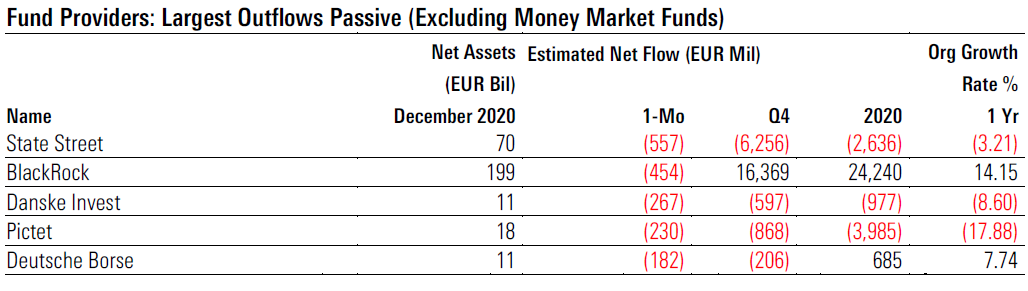

On the passive side, iShares topped the ranking of the asset-gatherers in December and the whole year of 2020 by a wide margin, netting inflows of EUR 14 billion in December and over EUR 51 billion in 2020. Most of the net new money in December was sent to US large-cap blend equity and global largecap blend equity funds, which received EUR 1.85 billion and EUR 1.7 billion, respectively. For the whole year, precious-metals exchange-traded products and China RMB onshore bond funds were the topsellers. Overall, iShares attracted EUR 51.4 billion last year, earning the first place of the 2020 ranking, followed by BlackRock (EUR 24.2 billion – Morningstar’s branding-name attribution distinguishes BlackRock’s index funds from iShares’ ETFs) and Vanguard (EUR 16.5 billion).

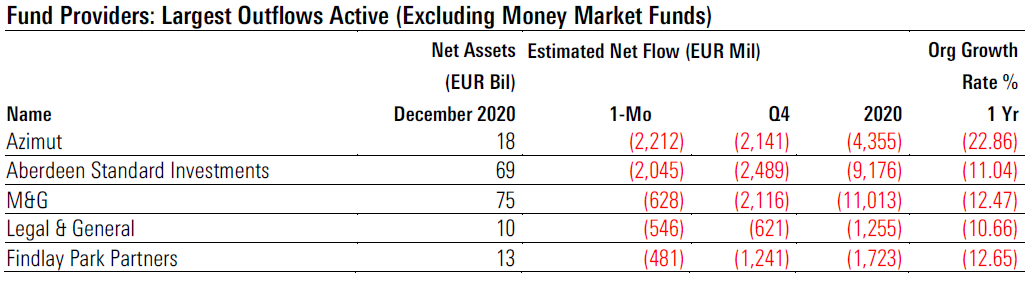

Fund Providers: The Laggards In the active spectrum, December saw heavy outflows hemorrhaging from the funds of Azimut, Italy’s largest independent asset manager. Aberdeen Standard Investment lost EUR 2 billion in December on the back of outflows from its GBP short-term bond funds; the Scottish asset manager has had only three positive months with regard to flows over the past five years. It is noteworthy that the emergingmarkets specialist did not benefit from the surge of European investors to emerging-markets equity and bond funds in the last quarter of 2020 (save China A-shares funds). Overall, after a poor 2019, Invesco had another bad year in 2020; the US provider suffered the highest outflows among active asset managers last year, with EUR 13.8 billion walking out the door.

Almost a third of that figure was due to consistent outflows from its largest fund, Invesco Global Targeted Returns. It sits in the alternative–multistrategy category, the year’s least favored category. Franklin Templeton and M&G also had it bad in 2020. These active managers saw outflows of EUR 13.2 billion and EUR 11 billion, respectively. Turning to the laggards on the index fund side, State Street suffered the highest outflows in December because of redemptions of EUR 941 million from the State Street Euro Corporate Bond Index Fund. Pictet shed EUR 230 million, thus making December of last year the 29th negative month for the Swiss provider’s index funds in the past three years. Pictet China Index was the main detractor in December, with EUR 137 million of net redemptions. State Street and Pictet’s index funds were the 2020 laggards on the passive fund side of the European fund market. The Swiss asset manager saw the highest outflows in 2020 within the passive universe (EUR 4 billion), followed by State Street (EUR 2.6 billion) and Scottish Widows (EUR 2.4 billion – products offered by the Edinburgh-based fund provider are distributed in the United Kingdom only).

The Largest Open-End Funds and ETFs Because of the equity rally in the fourth quarter and the typically strong inflows in December, the Swedish pension fund AP7 Aktiefond regained the title of Europe’s largest long-term fund at the expense of Pimco GIS Income Fund. It was also somewhat the lackluster inflows that tempered the growth of Pimco’s flexible-bond fund, which fell back in the ranking by net assets. The huge level of redemptions the fund had suffered in March were the driver of total year’s outflows of EUR 8.3 billion. Inflows sent to the Fundsmith Equity were reduced to a trickle in December, but the inflows of EUR 1 billion for the full year were strong when considering the significant underperformance that this fund, which carries a Morningstar Analyst Rating of Gold, has suffered lately. JPMorgan’s Global Income Fund and Allianz’s Income and Growth fund, which are both geared towards the higher-yielding segments of the bond markets, both suffered significant outflows in the past year.

Turning to index funds, inflows sent to the largest S&P 500 trackers offered by iShares and Vanguard rebounded in December, but this was not enough to compensate for the outflows suffered over the course of the year. The gargantuan inflows that targeted the institutional equity fund BlackRock ACS US Equity Tracker Fund in October were followed by two lean months in November and December. Vanguard’s Global Bond Index Fund continued to chug along comfortably in the fourth quarter. Last year’s inflow tally of EUR 3.2 billion was remarkable when considering the volatile flows of other global